arizona estate tax laws

No tax is due unless the amount exceeded the lifetime exemption. Chapter 12 - Property Classification.

Arizona Estate Tax Everything You Need To Know Smartasset

As of 2006 Arizona no longer levies an estate tax.

. Chapter 14 - Valuation of Centrally Assessed Property. The current federal estate tax is currently around 40. The trusts Arizona taxable income for the tax year is 100 or more.

We can also help you administer a loved ones estate to ease the burden of distributing the inheritance to others. The majority of statutes relating to property tax are referenced in Title 42 Taxation. Chapter 11 - Property Tax.

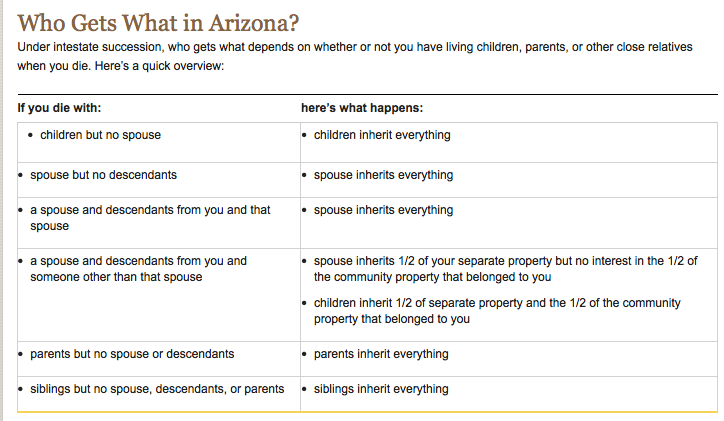

Probate is required in Arizona unless the decedent has a trust or listed beneficiaries for all assets. Arizona also does not have an inheritance tax or a gift tax. In Arizona as in other states ones estate is inherited by friends relatives or other beneficiaries according to the details in the written will.

Chapter 15 - Assessment Process. The official version of the Arizona Revised Statutes is published by Thomson Reuters. However estates worth more than 117 million are subject to federal estate tax.

2010 Estate and Gift Tax Law Changes. Federal state and local governments all collect taxes in a variety of ways. Most simple estates in Arizona are transferred from the owner to beneficiaries without tax.

As a result in 2011 and 2012 individuals over the course of their lifetimes could give or bequeath 5000000 indexed for inflation to anyone free of a federal transfer tax. This online version of the Arizona Revised Statutes is primarily maintained for legislative drafting purposes and reflects the version of law that is effective on January 1st of the year following the most recent legislative session. Click on a link below to learn more about Arizona estate planning laws including estate taxes.

Congress made significant changes to the federal estate tax rules and rates in 2010. While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005.

The estates Arizona taxable income for the tax year is 1000 or more. For decedents dying after 2004 Congress repealed the federal state death tax credit upon which the Arizona estate tax was based. Estate and Gift Taxes Chronology of Federal Estate and Gift Tax Law Changes.

Call 480-892-2488 today to schedule your free consultation. Arizona does not impose an inheritance tax but some other states do. Citizens will have to pay estate tax.

Additionally states levy extra taxes on items such as liquor tobacco products and gasoline. The federal inheritance tax exemption. Explore Arizona community property trusts wills powers of attorney estate gift taxes and how title to your assets affects your estate plans.

Statutes are laws passed by the Arizona Legislature. Chapter 13 - Valuation of Locally Assessed Property. If you own property in.

But there are states that do impose a state-level estate tax. As a result beneficiaries or heirs who reside in Arizona do not pay an inheritance tax but beneficiaries or heirs who reside in another state may be subject. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later.

Under the new laws the Arizona Estate Tax was based entirely on the maximum tax credit allowed by the federal tax laws for Estate Taxes paid to the states. By now you should understand how the gift tax works at both the federal level and at the Arizona level. We begin the class by exploring unique aspects of Arizonas income tax laws.

Therefore Arizona no longer has an estate tax. State revenues are comprised of property taxes sales tax and certain taxes on businesses. This exemption rate is subject to change due to inflation.

These include estate tax gift tax and inheritance tax. There is one exception to this rule which is for estates with personal property valued at less than 75000 and real property under 100000. Fewer than one-half of 1 of all US.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Age Category Adult 14 Location VLSC - Room 7 at Via Linda Senior Center Instructor Thomas Shellander. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. The family would need to submit an affidavit to the. At Phelps LaClair we can help you add your inheritance to your estate and design an estate plan that avoids probate.

There is a base tax. An inheritance tax is a tax levied by a state government on a beneficiary or heir who inherits assets from an estate. Images used under creative commons license.

All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. New Jersey phased out its estate tax in 2018. It later turned around and repealed the tax again retroactively to January 1 2013.

In this case it is known as a small estate. Tennessee repealed its estate tax in. Separate methods were established in.

Federal law eliminated the state death tax credit effective January 1 2005. Laws 1979 Chapter 212 repealed the Estate Tax Act imposed a new Estate Tax and levied a tax on generation-skipping transfers of property. Does Arizona Have an Estate Tax.

Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following. Fiduciary and Estate Tax. Form 709 gift tax return must be filed to show the 5000 amount over the exemption.

In Arizona for example gasoline is taxed at 18 cents per gallon sales tax is at 56 percent and beer is taxed at 16. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

In the absence of a will state probate court decides how an estate is handled. Nevertheless the estate is taxable only on the amount that exceeds the valuation threshold.

What Is A Real Estate Transfer Tax And Do I Have To Pay It In Arizona Law Office Of Laura B Bramnick

What Is Arizona Homestead Act 5 Most Common Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

4 Types Of Assets That Are Subject To Probate Brown Hobkirk Pllc

Arizona Estate Tax Everything You Need To Know Smartasset

The Revised Arizona Homestead Exemption Is The Homestead Exemption Still Beneficial Provident Lawyers

State Death Tax Hikes Loom Where Not To Die In 2021

Understanding Capital Gains And My Arizona Home Sale Law Office Of Laura B Bramnick

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona State Taxes 2022 Tax Season Forbes Advisor

Arizona Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

What Happens If There Is No Will In Arizona How It Works

How Your Estate Is Taxed Or Not

5 Things You Should Know About Probate Law In Arizona

Arizona Property Tax Calculator Smartasset

Arizona Voters Approve Massive Tax Hike On High Earners Could Your State Be Next